gst on commercial property sale malaysia

12018 setting out the goods and services tax rules concerning the sale of buildings on commercial land that are used for both residential and commercial purposes. The DG came out with a further decision on Oct 28 2015 stating that owning more than 2 commercial properties or owning more than 1 acre of commercial land worth more than RM2 million would be subject to GST if the individual has an intention to sell the commercial properties subject of course to the taxable supply exceeding the threshold of.

David Mcmillan Director Advisory Performance Property Linkedin

Any late registration will be subject to penalty based on number of days late which capped at RM20000.

. The current regulations might confused a lot of people who originally thought they were exempt from this levy according to Deloitte Malaysia an. Unlike the estate agents and negotiators the brokers are not registered under the Valuers Appraisers Estate Agents Act 1981. The Royal Malaysian Customs Department has recently issued a new guidance that would result in more people being subjected to the Goods Services Tax GST when they sell a commercial property.

For The First RM500000 10 Subject to a minimum fee of RM50000 For The Next RM500000 080. Keep in mind that tax rates change frequently and you should check the latest government information for up-to-date data. For The Next RM2000000 060.

Gst on commercial industrial property the sale of an. Any individual that supplies commercial property or commercial land worth more than 2 million ringgit at market price after 28 October 2015 shall liable to register for GST. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is engaged in the business.

Contractors engineers will be subject to GST with a standard rate of 6. The RPGT rates are as follows-. In other words non-commercial properties are not subject to the 6 GST.

If sold before 5 years. GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted. Our lawyers in Malaysia describe the provisions of the Public Ruling and can help you determine how the tax applies in your case for.

About Chat Property Malaysia. Under the new GST implementation all building materials and services Eg. It is not recommended to exceed this quota.

Unlike residential properties the sale of commercial properties is a clear cut case which falls under the Standard-rated supply and is taxable under the GST. Due to the high costs involved in purchasing commercial properties the risk is higher and more concentrated. If sold after 6 years.

In Malaysia the sale of commercial properties including land zoned for commercial purposes is usually subject to 6 GST. Individual Citizen PR Individual Non-Citizen For Disposals Within 3 years. Under GST the sale of commercial buildings and land zoned for commercial is usually subject to 6 GST if sold by a person in business.

GST is also charged on importation of goods and services into Malaysia. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent GST if the seller is an individual is engaged in the business. If sold before 4 years.

What is Real Property Gain Tax RPGT. Many thought that private properties would fall outside of this category. All groups and messages.

However for the purposes of GST regardless whether brokers are liable to be registered under. Payment of tax is made in stages by the intermediaries in the production and. Metered User access status.

24 February 2016. Malaysia such brokering services on the property sale transaction may also be provided by the brokers. RPGT is a tax chargeable on the profit gained from the disposal of a property and is payable to the Inland Revenue Board.

In most cases yes you will be required to pay GST on a commercial property purchase. The fees however follow a standard table whereby the price of the property determines how much a property purchaser has to pay. Goods and Services Tax GST is a multi-stage tax on domestic consumption.

In Malaysia the sale of commercial properties including land zoned for commercial purposes is usually subject to 6 GST. For The Next RM2000000 070. However for the leasing of commercial property will be subject to 6 GST.

Instead of beating around the bush there is a clear pricing scheme for properties of these kind where there is a segregation between the. Late Registration Period Days Cumulative RM 1 30. GST on commercial industrial property The sale of an existing and new commercial from LAW MISC at Malaysia University of Science Technology.

Generally real estate should take up only 40 to 50 of the portfolio. Still to pay for 1 year. However some investors might forget to include GST into their budget and this is a big mistake- because the figures involved can be significant.

This will invariably raise the production cost. RPGT increases progressively as follows for commercial property. The guidance points out that under paragraph 2 1 e of the First Schedule of the Goods and Services Tax Act GSTA 2014 the.

It is a crucial step in your investment roadmap. The current regulations might confused a lot of people who originally thought they were exempt from this levy according to Deloitte Malaysia an. Public Ruling No.

Meanwhile other building materials fall inside Second Schedule Goods in which all the goods in this category will only be charged sales tax of 5. Given that commercial and industrial properties are not Exempt Rated goods but falls under Standard Rated items the GST will have a greater impact on these segments. Under existing the rules the sales of commercial real estate like officeretail buildings and land zoned for commercial use are liable for the six.

Below is the table. Whether buying selling or leasing you will be classified as an enterprise and according to Australian Tax Office once an investor or developers turnover is at or above 75000 they are liable to pay GST. Investors should ensure that they can stomach the risk before taking up the investment.

Sale of commercial properties will be subject to 6 GSTDevelopers may choose to absorb GST as part of their sales package. If sold within 3 years. For instance a shop sold for RM3 million will be subject to.

Malaysias tax agency has released Public Ruling No. However according to the guidance released by the authorities the facts. Whether youre buying an office building.

12018 issued by the Malaysian Tax Agency sets forth the applicability of the goods and services tax on the sale of buildings located on commercial land used for both commercial and residential purposes.

How Banks Fooled You With The Rule Of 78 Rule Of 78 The Fool Learning Centers

Brigade Residences At Wtc 3 Bhk Premium Apartments Perungudi Omr Chennai Brigade Group

Commercial Real Estate Property For Sale In Griffith East Nsw 2680

Ian Treloar Managing Director Gill Property Linkedin

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

The Curious World Of Nft Real Estate And Design Deccan Herald

Pin By Uncle Lim On G Newspaper Ads Real Estate Advertising Forest City Future City

Check Out Our Ad In The Times Of India Www Paradisegroup Co In Utm Content Buffer Real Estate Marketing Postcards Real Estate Ads Real Estate Marketing Design

Commercial Real Estate Property For Lease In Pomona Qld 4568

How Banks Fooled You With The Rule Of 78 Rule Of 78 The Fool Learning Centers

How Is Car Depreciation Calculated Credit Karma

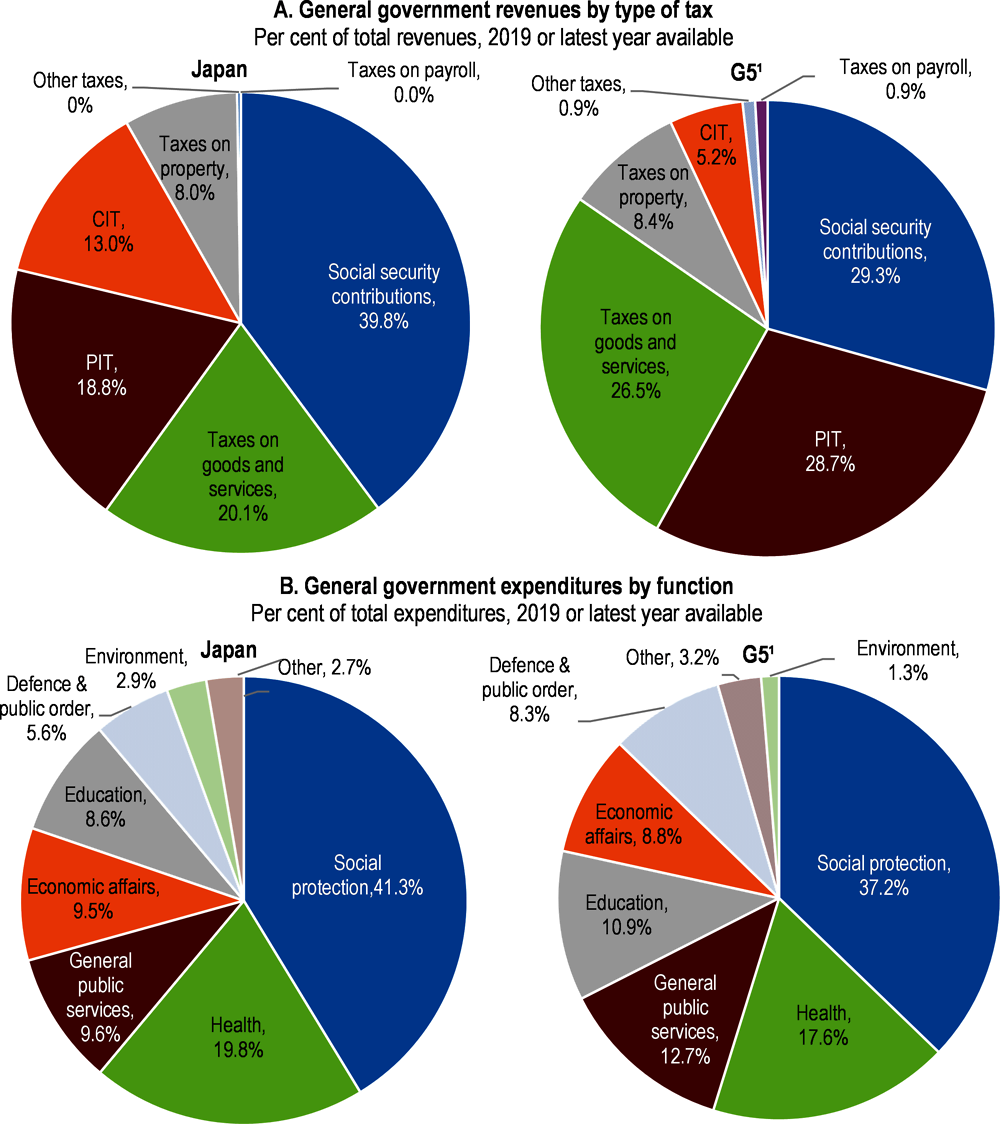

1 Key Policy Insights Oecd Economic Surveys Japan 2021 Oecd Ilibrary

David Mcmillan Director Advisory Performance Property Linkedin

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Property In Kunchanapalli Vijayawada Real Estate Property For Sale In Kunchanapalli Vijayawada

Commercial Real Estate Property For Lease In Pomona Qld 4568

Is It Time To Reithink Your Investments Investing Infographic Finance